Introduction

While Odoo and AvaTax are two separate software programs with different functions, they can be combined to simplify several corporate processes, especially those related to enterprise resource planning (ERP) and taxes.

AvaTax

Developed by Avalara, a platform that specializes in automated tax software and compliance services, AvaTax is a cloud-based tax compliance solution. For companies of all sizes, AvaTax is made to streamline and automate the process of computing sales tax, VAT, and other transactional taxes.

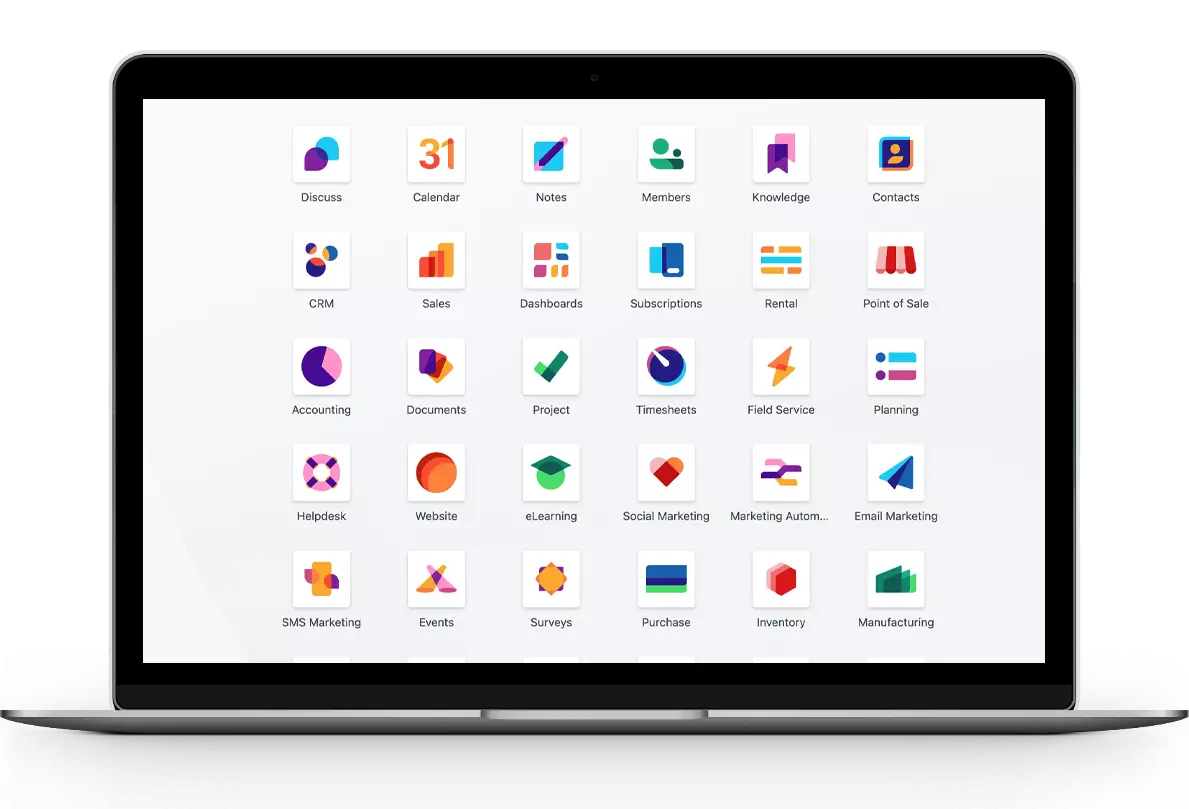

Odoo

Odoo is an ERP software suite available as open source that provides an extensive range of corporate applications spanning several areas like accounting, human resources, inventory management, CRM, and more. It gives companies a modular approach to developing and tailoring ERP systems to meet their unique requirements.

Customer Challenges

There are many advantages to integrating AvaTax with Odoo, but like with every integration project, there are drawbacks as well. The following are typical challenges faced by the customer while integrating AvaTax with odoo:

Complexity of Tax Rules: Tax laws are complicated and differ greatly between the various jurisdictions. It was difficult for the customer to make sure that AvaTax correctly applied the appropriate tax rates and rules within Odoo's workflows, particularly for customer that operate in several locations with various tax laws.

Data Mapping and Synchronization: To guarantee smooth communication, mapping data fields between the two systems is necessary for integrating AvaTax with Odoo. It was challenging to set up this mapping and synchronize data efficiently, especially when the customer was working with huge amounts of transactional data in Odoo.

Customization and Configuration: To comply with the tax rules and business procedures of the customer, AvaTax integration needs more customization or configuration. It was difficult to strike a balance between preserving system stability and the demand for customization.

Compliance and Regulatory Changes: Maintaining compliance required timely updates to the Odoo integration of AvaTax to stay informed of these developments. Failing to do so may lead to tax estimates being inaccurate or tax regulations not being followed.

Our Solutions

We have greatly simplified our customer’s tax compliance procedures by integrating Odoo with AvaTax. Here is a step-by-step tutorial of how we did a successful and guaranteed of AvaTax with odoo:-

Key features of Our Integration:-

Select Integration Method: We choose the integration technique that most closely matches our customer’s requirements and technical capacity. Pre-built connectors for well-known ERP systems, APIs are just a few of the integration options that AvaTax provides. Select the approach that best suits our development resources and technical setup.

Map Data Fields: We identify the data fields in Odoo that correspond to the required information for tax calculation in AvaTax. We Mapped those data fields between Odoo and AvaTax to ensure accurate transmission of transaction data.

Implement Tax Calculation Logic: We developed features within the integration module to trigger tax calculations for relevant transactions in Odoo. We Ensured that the integration accurately applied the appropriate tax rates, exemptions, and rules based on the transaction details and relevant tax jurisdictions.

Handle Tax Exemptions and Special Cases: Account for any tax exemptions, special tax scenarios, or account-specific tax rules that may apply to our customer’s business. Implemented features within the integration to handle these cases appropriately and ensure accurate tax calculations.

.webp)